President Donald Trump’s trade and immigration policies risk worsening the housing affordability crisis that helped fuel his 2024 electoral victory. With tariffs increasing construction costs and deportations shrinking the labor pool, America faces a potential surge in home prices and rents, compounding an already severe shortage of affordable housing.

Read: Landlord Pays $685,000 to Settle Tenant Harassment in California

Housing Crisis Drives Politics

Rising housing costs played a pivotal role in Trump’s 2024 election win, as typical American home prices climbed nearly 40 percent during Joe Biden’s presidency. Approximately 771,480 Americans lacked stable shelter in 2024. This crisis is especially acute in Democrat-led states like California, where median home prices exceed ten times median incomes, far above the healthy three-to-five ratio economists recommend. Mortgages and rents emerged as the largest household expenses motivating voters, overshadowing cultural debates dominating media coverage.

Also read: 200-Year-Old Windmill Converted to Family Home Hits Market for £900,000

Trade War’s Construction Toll

On April 2, after delays and false starts, the administration launched a global trade war imposing a 25 percent tariff on goods from Canada and Mexico, excluding Canadian softwood lumber and Mexican gypsum, key building materials. The National Association of Home Builders (NAHB) hailed the exemption as a victory, noting Canada supplies 85 percent of U.S. lumber imports. Had tariffs applied fully, home costs might have risen by $29,000, potentially halting many construction projects due to thin profit margins.

Also read: Tenants Fight Back After Illegal Evictions Shake Missouri

Rising Building Costs Persist

Despite exemptions, existing tariffs already added $10,900 to the average new home cost by April 2025, up $1,700 from March, per NAHB estimates. This compounds a 41.6 percent increase in building materials since 2020, stemming from pandemic supply chain disruptions. Renters may bear the brunt of these increases, as America faces a shortage of approximately five million homes, mostly apartments, due to underbuilding since the 2008 financial crisis.

Also read: Olympia Weighs Limits on Landlord Access to Tenant Screening Data

Vacancy Rates and YIMBY Success

Urban economics shows that rising vacancy rates lower rents, but boosting vacancies requires more construction. While most cities have seen stagnant or declining development, a few such as Austin and Minneapolis have bucked the trend with building booms that helped bring prices down, thanks to YIMBY (“yes in my backyard”) advocacy. These cities remain exceptions amid broader underproduction.

Also read: Homeowner Restores 160-Year-Old Door to Original Chestnut Glow with Handwork and Patience

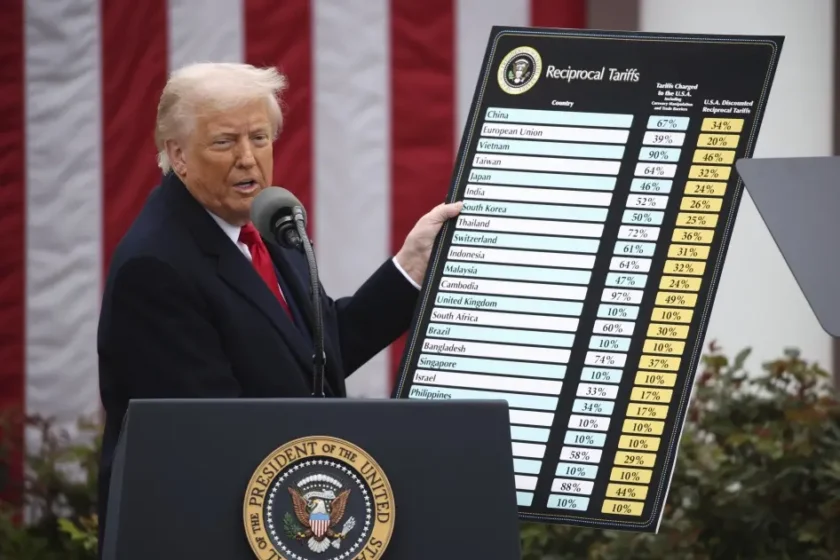

New Tariffs Loom Large

The administration imposed a 25 percent tariff on steel and aluminum imports from allies like Brazil and Germany on February 11. A copper import investigation launched on February 25 signals possible future tariffs. Key inputs including iron and cement now face steep tariffs depending on origin. These will drive up construction costs, while tariffs on appliances such as microwaves, refrigerators, and air conditioners raise prices further, as both imports and domestic production become more expensive.

Also read: New York City Brokers Fight Law Banning Fees for Renters

Construction Market Uncertainty

Tariff uncertainty has stalled many projects and battered homebuilder stocks. Smaller developers are exiting the market. The article warns, “Following in the mold of autarkic Cuba where international trade is strictly limited and medical doctors drive taxis for a living your next Uber driver could very well be an out-of-work former developer.” This is a troubling prospect as American cities desperately need more housing.

Also read: Lexington County Council Votes to Keep Property Taxes Flat for Homeowners

Immigration Clampdown’s Impact

The administration’s mass deportations threaten to worsen labor shortages in construction, which already lack about 250,000 workers. About 30 percent of U.S. construction workers are immigrants, many undocumented. In California, immigrants comprise 41 percent of construction labor; in Texas, nearly 60 percent of immigrant workers in construction are undocumented. Trump’s prior immigration restrictions suppressed a needed construction boom, and renewed crackdowns risk intensifying the housing crisis.

Also read: Most Affordable U.S. Cities to Buy a Home Today, Study Reveals

Policy Disconnects

While the administration has acknowledged the housing shortage by proposing to release more federally owned land for development, this measure offers only limited relief focused on Western cities. Worse, the administration is rolling back efforts like the Affirmatively Furthering Fair Housing (AFFH) rule aimed at reducing local regulatory barriers. HUD chief Scott Turner scrapped AFFH in February, stating it would “cut red tape” and “advance market-driven development.” Critics note the rule mostly required local governments to report on and address barriers to housing.

Also read: Design Trends Falling Out of Favor This Year

Federal vs Local Roles in Zoning

Most zoning and permitting authority rests with state and local governments, limiting federal influence. Yet the federal government could incentivize deregulation by conditioning funds on local reforms. Bills like the “Build More Housing Near Transit Act” and “Yes In My Backyard Act” propose linking federal transit or public facility funding to local reductions in housing restrictions. Additionally, removing federal tax benefits for homeowners in high-cost, low-production cities could shift local politics toward greater housing supply. Meanwhile, state legislatures from Montana to Washington and even California are increasingly passing laws to restrict local housing bans and promote development.

Next up: